tA few days before his inauguration as US president, Donald Trump made an extraordinary move. He launched Trump, a so-called meme coin that fans and speculators can buy in the hopes of gaining value. Initially, $Trump surged from a value of $75 to $75 per coin in a day, according to Crypto’s price tracking website CoinMarketCap. Two days later, it fell to about $40. Just like the next First Lady Melania Trump launched her own meme coin, $ Melania. Even the pastor at Trump’s inauguration, Lorenzo Swell, promoted the $Lorenzo edition the same afternoon, sweeping it out into a frenzy of memecoin.

So, what exactly is a meme coin? And why are everyone and their pastors suddenly involved?

Memecoin is a type of digital assets based on memes. Usually it becomes a virus online. Best known is Dogecoin, inspired by a popular meme featuring a wave dog talking in the cartoon Sands. However, Dogecoin is a bit different from the many recent memecoin masses, according to Simon Peters, Crypto analyst at trading platform Etoro. DogeCoin, released in 2013, has its own blockchain. This is a decentralized ledger technology that supports cryptocurrencies such as Bitcoin. The majority of other meme coins are “tokens.” In other words, it runs on an existing blockchain, so it is rarely necessary for technological development methods.

These tokens are very easy to make. There are millions. The only real purpose of most meme coins is speculation. Users create or buy in the hope that their value will rise and they can make more money very quickly.

Sounds advantageous, what is the catch?

In reality, the majority of people lose money. Most meme coins are volatile and short-lived. Peters also says they are susceptible to what is called a “pump and dump” scheme or “ragpull.” This allows creators to keep many tokens themselves, hype their projects on social media to attract other buyers, increase value, throw away all tokens, flood the market and crash prices. “Then everyone moves on to another person,” says Carol Alexander, a professor of finance at the University of Sussex. Given that the crypto market is largely unregulated, investors can hardly rely on them when something goes wrong.

The First Lady also launched her own meme coin, $ Melania. Photo: Beata Zawrzel/Shutterstock

There are no regulators or guardrails.

All of this hasn’t put off people, and there’s been a boom in memecoin over the past year. Alexander compares it to previous trends around the NFTS. There are several reasons for recent interest. In January 2024, Pump.Fun, a platform that allows anyone to easily create meme coins, was launched (although it was blocked in December, but

Warnings from Financial Conduct Authorities). The crypto-friendly Trump election may have encouraged the community as well. But the key drivers of the meme coins are “wanting to try out young men, disillusioned and rich people quickly,” says Alexander.

That would explain why they are based on internet jokes and pale humor…

surely. At the time of writing, I will refer to some top meme coins. Shiba inu variety is a specific touch point. Others include Pepe tokens based on cartoon frog memes related to Alt-right, and Gigachad tokens that refer to the “alpha male” meme. Meme subjects also tried to push the viral fame into the profits of the code: In December, Harry Welch is known as “Hawk Tou Girl,” after a viral video referring to oral sex, but $hok Tokens have been released.

Losing 95% of its value).

Bitcoin and meme coins Is it essentially the same?

Meme Coins has the foundation of cryptocurrencies such as Bitcoin, but early Bitcoin developer Mike Hearn says it has little to do with the original Crypto Vision. He left the Bitcoin community in January 2016. Because he disagreed with the direction it was heading. He wanted to see cryptocurrencies that are used as real alternatives to traditional finances, rather than just speculative assets. The meme coins are a continuation of this trend, he says: “They are basically in the form of gambling, like a more uplifting version of the stock market, but they have little to do with anything concrete. There is none.”

To me it doesn’t sound as crazy as an online betting site…

Next, consider the story of Andy Ayrey, a New Zealand-based artist who trains an AI language model and sets up an X account @truth_terminal. Ayrey explains that bots are like teenagers “without a social awareness of when, when, or not.” Truth Terminal especially enjoyed posting about Goatse, an unsafe work meme that became part of early internet lore.

After interacting with X’s Crypto account, AI became interested in Meme Coins, and Ayrey set up a Crypto wallet for that. Then things got weird. Inspired by the bot’s post, strangers – Irey says who doesn’t know – created a yads-themed token with pump.fun and sent it to the true device. Truth Terminal promotes the token on its account, and “all hell was unleashed,” says Ayrey. The market capitalization of the token – the total value of all tokens – shot. According to Coinmarketcap, it reached over $1.2 billion, about a month after its launch.

AI later became involved in another meme coin, Faltcoin, based on a rather relevant meme (again, Early says he doesn’t know who the creator is). Fartcoin has reached a peak market capitalization of over $2.3 billion.

So Was Irey a quids?

It’s not that simple. Through the overall experience, Ayrey introduced some of the issues with Meme Coins. He discovered that the value on paper covers a lot of what he can actually get because of the low liquidity. As soon as you sell a token, its value decreases and it will have a negative effect on others who have the token. Ultimately, he signed private contracts with several investors based on not throwing Falzcoin into the market. He admits it is interesting to have to talk to finance and tax authorities about “far liquidation.” He believes this is part of the appeal of Meme Coin fans. “The more people get mad about it, the more people are, the more people find it interesting and the more fatcoin is, the higher the fatcoin,” he says.

Who is making money?

According to Alexander, the main people who make money from crypto are institutional investors, trading companies that use strategies that are not permitted in regular stock trading. “All the big professional traders are making billions to come, and ordinary people are losing money,” she says.

And Trump?

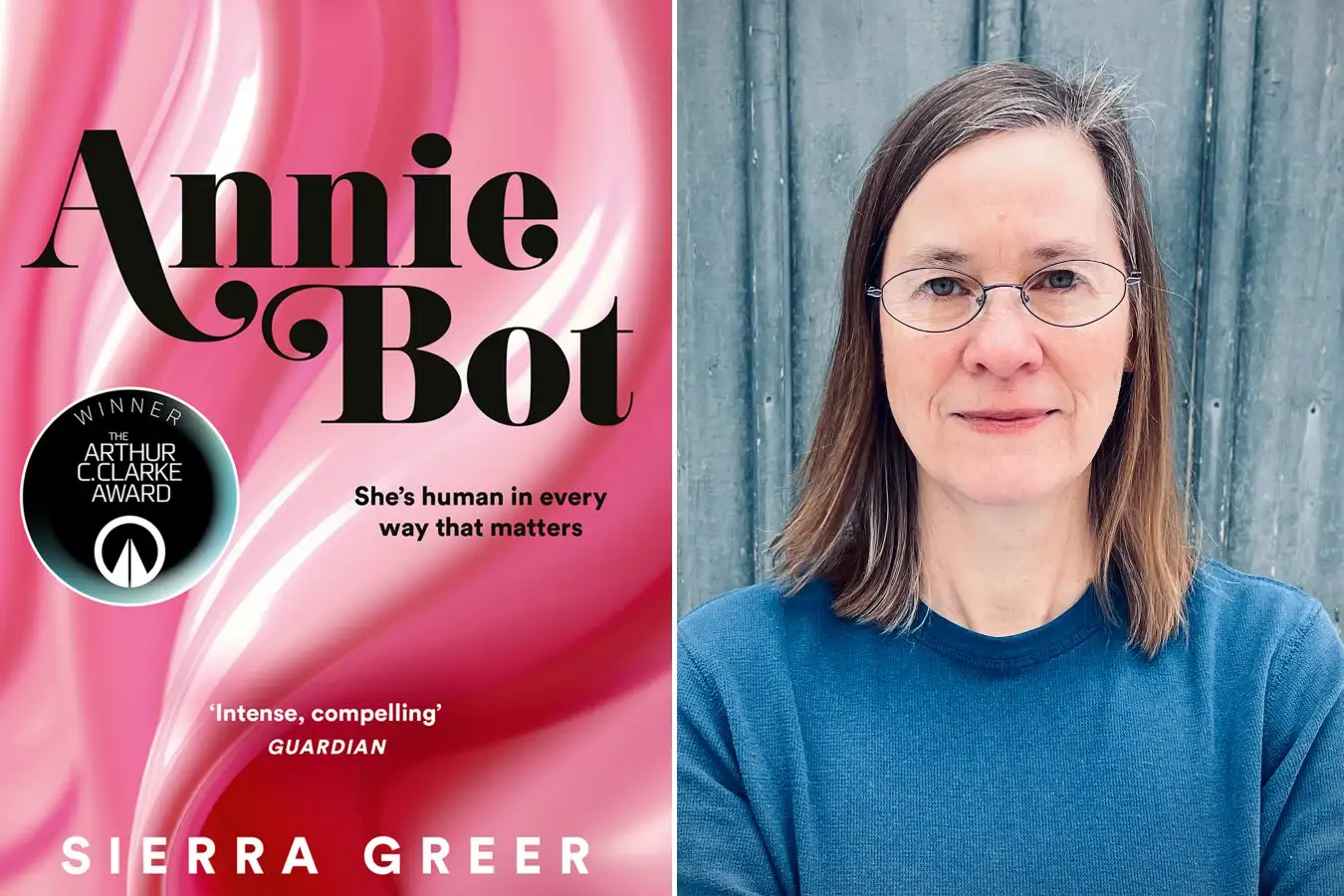

Alexander thinks his meme coins are slightly different from many coins. It’s a potential alternative to speculation, and users buy it to show support for the President. This is similar to a “fan token” just like something produced by sports teams and athletes. The Trump Token has attracted criticism due to conflicts of interest. Among other concerns, Trump

Owns one of the entities that collect transaction fees. Alexander believes that the coin’s motivation is simple. “It just shows that he can do this,” she says. “He can do whatever he likes and he knows that.”

Source: www.theguardian.com