Greetings! Welcome to TechScape. I’m your host, Blake Montgomery. If you wish to subscribe to our newsletter, please share this email with 5 friends and encourage them to sign up, much like a chain letter promising 5 years of bad luck. This week in news, AI companies have reached astonishing financial highs, with valuations soaring to $5 trillion, a record $100 billion quarterly earnings, and a series of agreements totaling close to $600 billion.

The staggering numbers of the AI boom make criticism challenging.

Last week, Nvidia’s market valuation hit the $5 trillion mark. Just three months earlier, it had become the first company ever to reach a $4 trillion valuation. Similarly, Microsoft joined Apple in hitting the $4 trillion valuation last week. In addition, companies like Meta, Microsoft, Amazon, and Alphabet reported massive quarterly earnings. Notably, Google’s parent company generated $100 billion in its first quarter. Amazon experienced remarkable expansion in its cloud computing sector, leading to a 13% increase in its stock price. However, Meta faced an unexpected tax bill of $16 billion. All major tech firms except Apple have increased their capital spending forecasts, indicating plans to invest billions more in the essential infrastructure that backs AI. These revisions alone add tens of billions to an already staggering total in the hundreds of billions. For instance, Alphabet has projected capital expenditures of $91 billion to $93 billion for next year, an increase from the $75 billion initially stated in February and the revised $85 billion announced in July.

Not to be outdone by its publicly traded competitor, OpenAI has transitioned to a for-profit model and is contemplating an initial public offering with a potential valuation of $1 trillion. The world’s highest-valued startups are actively making deals, including a partnership with Nvidia that involves an investment of $100 billion in OpenAI as of September. Furthermore, Microsoft recently entered a contract with OpenAI for $250 billion in Azure cloud services. Oracle, another cloud services giant, also struck a $300 billion investment agreement with OpenAI in September. On Monday, the creator of ChatGPT announced a $38 billion deal with Amazon Web Services, as OpenAI commits to a staggering total of $588 billion in expenditures over the coming years.

Nvidia is now valued higher than Germany’s total annual economic output projected for 2025, estimated at $4.66 billion. To put this into perspective, Nvidia’s market capitalization surpasses the collective valuation of all German companies, which is expected to be approximately $2.4 trillion in 2024, according to the World Bank. No single company should eclipse the world’s third-largest economy, a nation with 83.5 million residents whose economic landscape supports an entire continent.

read more: Boom or bubble? Inside $3 trillion in AI data center spending | Artificial Intelligence (AI) | Guardian

Understanding the economics surrounding the AI boom poses significant challenges, hindering straightforward criticism. How should one respond to such overwhelming data? Even the keenest analyses can feel dwarfed by the magnitude of a billion-dollar data center. The scale of these figures defies comprehension; there’s hardly a personal context with which to relate. How do we consider a spending plan of $91 billion? What does it mean to make choices in the realm of hundreds of billions? It’s bewildering. Describing Meta’s earnings as “mixed” feels odd, yet that’s the assessment from Wall Street experts.

The boom has seen billions circulating in transactions between these corporations, raising red flags regarding inflated valuations and financial risk. If one entity stumbles, a domino effect could ensue, potentially dragging the U.S. economy down with it. Nonetheless, these companies show no signs of diminishing their collective enthusiasm.

File photo: COMPUTEX in Taipei

File photo: Nvidia Blackwell GPUs on display at COMPUTEX in Taipei, Taiwan, June 4, 2024. Reuters/Ann Wang/File photo

Photo: Anne Wang/Reuters

On the populist front, critics argue that AI has failed to establish any significant use cases beyond something as trivial as assisting with homework. Regardless of how many jobs a CEO might eliminate, replacements will remain inadequate. Approximately 95% of AI pilots that companies have undertaken have faltered, as MIT researchers discovered in August.

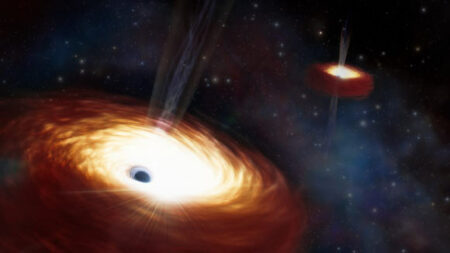

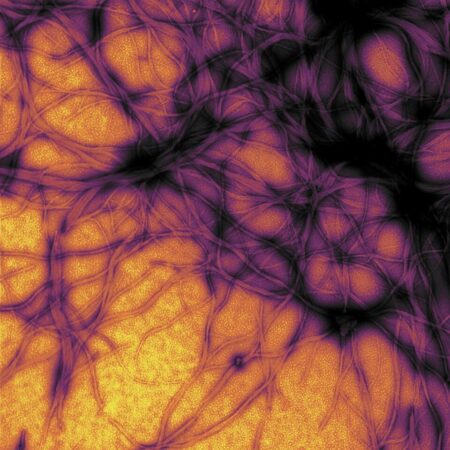

The economic magnitude of the AI boom is unfathomably vast, corresponding with its digital scale. Large language models like ChatGPT and Claude Sonnet operate partially through parameters—variables that help the model predict subsequent words. These invisible adjusters can modulate responses by the hundreds of billions, with projections indicating that GPT-5 could reach into trillions.

The physical ramifications of AI mirror the considerable economic scale of this technology. Dara Kerr, a technology reporter for the Guardian, recently reported from the Tahoe-Reno Industrial Center, which houses the largest data center in the nation along with several smaller establishments. She detailed its extraordinary scale:

The Tahoe-Reno Industrial Center stretches from Interstate 80 to the mountains of the arid Nevada desert. This vast complex encompasses tens of thousands of acres and houses roughly 200 companies involved in logistics, fulfillment, and data center technology, including Google, Microsoft, and Tesla. Some firms maintain multiple data centers spanning several times the length of a football field throughout desert valleys. This industrial area occupies 65% of the county’s land, creating a scale that’s nearly incomprehensible.

Should you purchase that gadget?

After newsletter promotion

You can now wager on American elections by contributing to the President of the United States

US President Donald Trump

Photo: President Donald Trump via Truth Social and Reuters

Donald Trump’s Truth Social is collaborating with Crypto.com to facilitate betting on election outcomes, as announced by its parent company last week. Trump Media and Technology Group is set to launch a “Truth Prediction” feature allowing users to “trade predictive contracts on major events and milestones, ranging from political elections to changes in interest rates, inflation, commodity prices, and significant sports events,” although a launch date remains uncertain.

TMTG Director Devin Nunes stated regarding the feature, “For too long, elites have strictly controlled these markets. With Truth Prediction, we’re democratizing information, enabling regular Americans to harness collective wisdom and converting free speech into actionable foresight.” Ironically, Nunes criticizes the “global elite” from a position of notable power within the government.

There’s something unsettling about this arrangement, as if the contender in a match is simultaneously the bookmaker. Mr. Trump, as President, invites voters to invest in his campaign while implementing policies that directly impact the interest rates users can wager on. As he flirts with the notion of an unprecedented third term, does the American public want to take bets on his potential to achieve it?

Even creating the truth prediction feature seems like a dubious endeavor. Crypto.com has contributed $11 million to Trump’s initiatives, as reported by the Financial Times. Additionally, the U.S. Securities and Exchange Commission closed its investigation during Trump’s administration while the company sought banking authorization from regulators. Trump Media and Technology Group signed a substantial deal to acquire billions of dollars’ worth of Kronos, the token associated with Crypto.com.

Gambling has become increasingly ingrained in American culture, with trading on election outcomes only legalized last year. A recent analysis by the Financial Times observed that the betting volume on prediction markets like Karshi averages $1 billion each week. This trend initiated with sports betting, which has reached unprecedented levels. My colleague Brian Armen Graham discussed the fallout from a scandal that shook the professional basketball world before Halloween, dubbed Operation No Bet, leading to the arrest of NBA players, coaches, and dozens of others.

The NBA gambling scandal marks the peak of a lengthy relationship between professional leagues and the massive gambling industry, which has transitioned from partnership to controversy. This represents the most significant corruption crisis in Major League Baseball following the legalization of gambling in numerous U.S. states and serves as a clear reflection of how embedded gambling has become within professional sports.

When will politics face its own “no-bets strategy”?

Wider TechScape

Source: www.theguardian.com