ShareChat is in the final stages of discussions to secure about $50 million in new funding that would bring the startup’s valuation below $1.5 billion, according to two people familiar with the matter.

Existing backers including Temasek and Tencent are among the investors in advanced stages of talks to invest in the new round, the sources said, asking not to be identified as the matter is private. Stated. ShareChat has been in talks with several potential new investors this year, and one of the potential investors the startup has engaged says that ShareChat is expected to receive a high valuation compared to its current low revenue. Many investors are hesitant to take this opportunity because of the current situation.

The terms of the negotiations are still ongoing and could change slightly, according to people familiar with the matter, but ShareChat’s current valuation is less than $1.5 billion, which is the same as when ShareChat raised funding early last year. This is a significant drop from its valuation of $4.9 billion.

The round could be completed as early as the end of the year. ShareChat did not immediately respond to a request for comment Wednesday morning. Temasek declined to comment, citing its own policies.

The loss-making Bengaluru-headquartered startup, which operates a social network and counts X, Snap and Tiger Global among its backers, has raised more than $1.4 billion so far, according to venture intelligence platform Tracxn.

Amid the TikTok ban, ShareChat’s failed bet in India’s short video space forced it to raise capital and prompted a price cut. (TechCrunch exclusively reported earlier that in late 2020 and early 2021, X considered acquiring ShareChat in a $2 billion deal.)

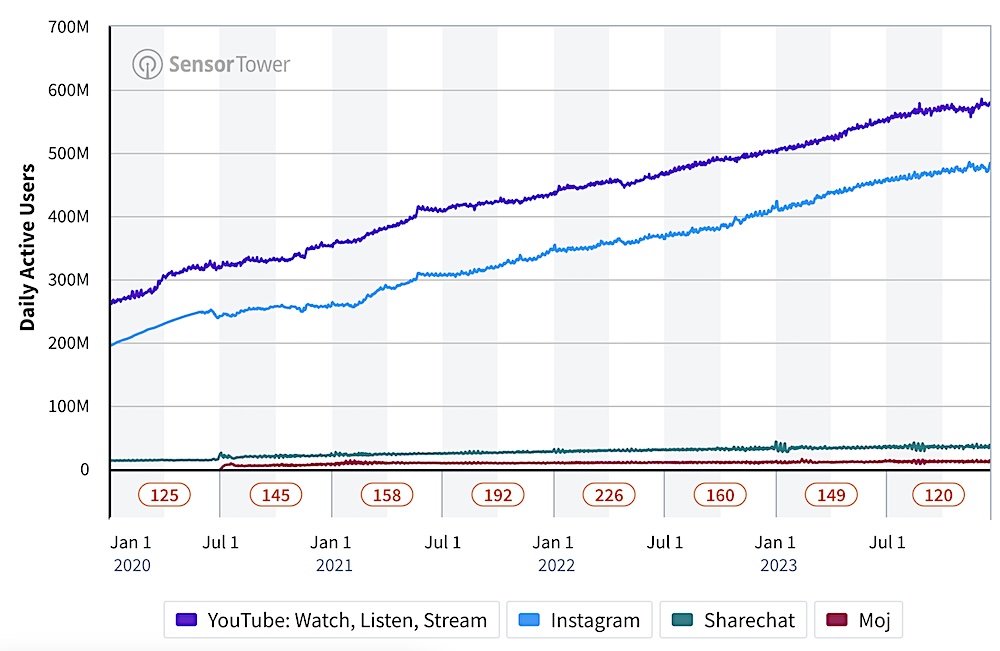

Sensor Tower estimates daily active users of Google’s Android platform in India (shared with TC by industry executives). In an official statement, ShareChat claims to have over 300 million monthly active users.

ShareChat, which launched short video app Moj in mid-2020, doubled its position in the category by acquiring MXTakaTak, a video app in the Times Internet portfolio, for more than $600 million. But industry analysts say YouTube and Instagram have filled TikTok’s void as creators migrate to these much larger platforms.

Eight-year-old ShareChat is scrambling to find ways to grow revenue and cut expenses after its two co-founders left earlier this year to start a new startup. It has tried a series of initiatives, including a fantasy sports app and a live voice chat service. However, sales were still lower at the end of the fiscal year ending in March. $65 million. The company plans to cut another 15% to 20% of its workforce in the coming weeks, another person said.

Many investors around the world are devaluing their holdings in startups, as the prolonged economic slowdown has also reduced the valuations of nearly all publicly traded technology companies. Prosus recently lowered Byju’s valuation to less than $3 billion from $22 billion in early 2022. Byju’s has raised more than $5 billion through equity and debt.

Source: techcrunch.com