On a gloomy November day in England’s Cotswolds, a VX4 that looked like a cross between a plane and a helicopter rose from an airport runway, hovered a few feet off the ground before sinking.

It may not have reached that high of an altitude, but it was a seminal moment for British owner Vertical Aerospace. The company has received millions of pounds of support from British taxpayers but is running out of money.

The flight came amid tense negotiations with investors that could see founder Stephen Fitzpatrick lose control to a US hedge fund, with the electric aircraft tethered to the ground for safety. We showed evidence that it is possible to transport people without having to carry them.

Verticals have already experienced what can happen when things go wrong. On a sunny day in August last year, the adhesive holding the blades of one of its eight rotors in place broke, causing the unmanned aircraft to crash onto the runway. The 3.7-ton aircraft crashed into a 30-foot crumpled heap, its blade landing 50 meters away. There were no injuries.

The accident and financial difficulties highlight the difficulty of making flying taxis a reality. Almost a century of effort. Vertical announced on Tuesday that the date its first aircraft would receive approval from UK regulators to carry passengers will be pushed back by another two years to 2028.

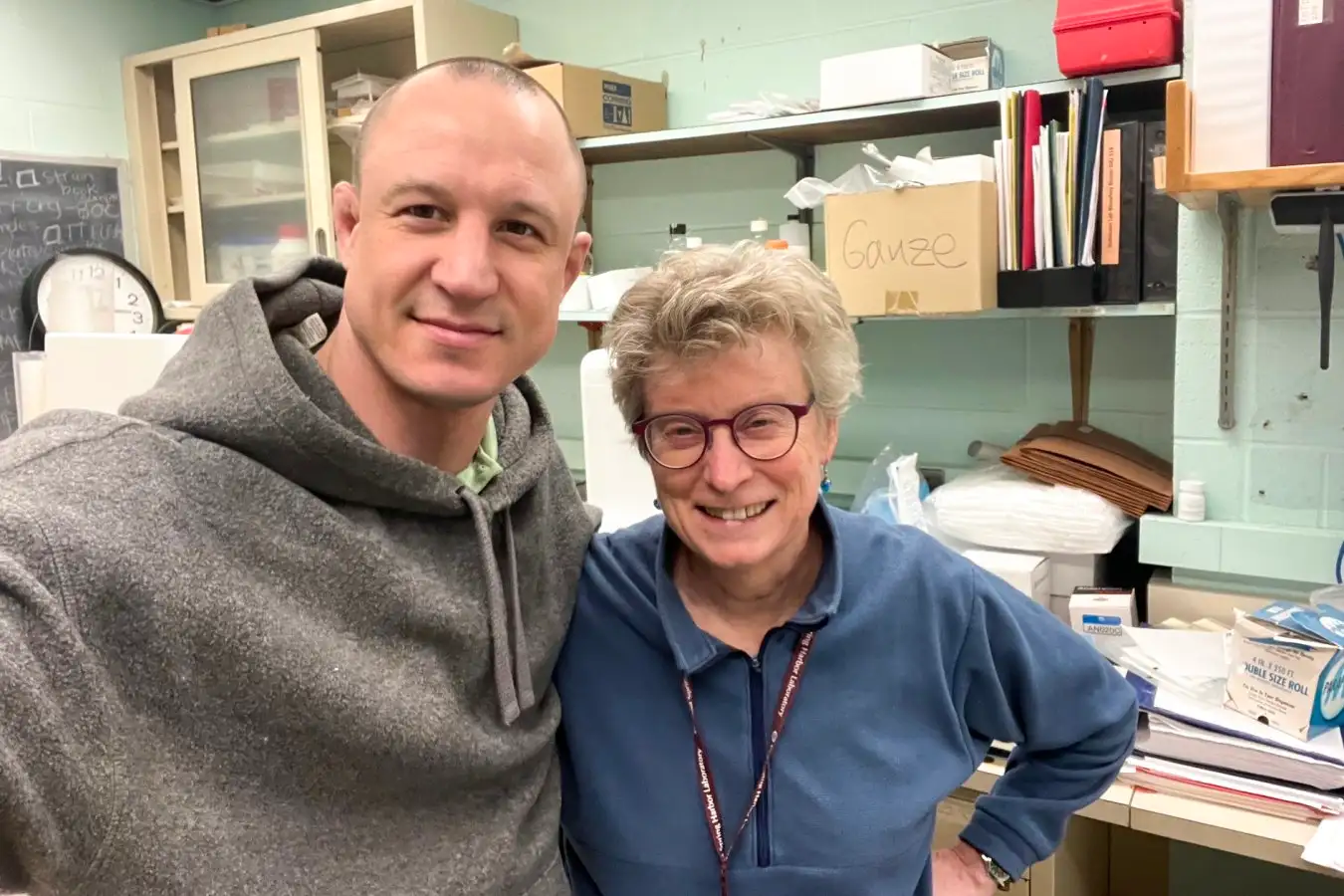

Stephen Fitzpatrick founded Vertical in 2016. Photo: Geoff Overs/BBC/Reuters

Vertical initially claimed the aircraft would have room for four people, a range of 160 miles, a top speed of 150 miles per hour, and would enter service by 2025. Vertical chief executive Stuart Simpson confirmed to investors this week that the company had chosen the UK as its destination. A factory that manufactures 200 aircraft a year. But cautious regulators and suppliers paid a price for the ambitious schedule.

A number of startups are trying to develop flying taxis, known in the industry as electric vertical takeoff and landing vehicles (Evtol). For several years, they seemed to be making rapid progress as investors sought empty Teslas, backed by cheap money.

Flying taxi companies such as Joby Aviation and Archer Aviation in the US and Volocopter in Germany have raised large sums of money and built flying prototypes. Three major aircraft manufacturers are participating in this competition through their subsidiaries: Europe’s Airbus, America’s Boeing, and Brazil’s Embraer.

Vertical took advantage of that wave. Fitzpatrick, an entrepreneur who also invests in F1 teams and derives most of his £800 million fortune from energy company Ovo, founded Vertical in 2016. The company was listed on the US stock market in 2021 with a valuation of $2.2 billion.

But rising interest rates and slow development are causing investors to pause before pouring in more money. Vertical’s stock price has fallen 95% since the coronavirus pandemic bubble, valuing it at just $110 million.

U.S.-listed peer Lilium filed for bankruptcy for its German subsidiary last month and is looking for a buyer to rescue it. Bloomberg reported on Wednesday that Chinese automaker Geely is in talks to bail out its Volocopter after its value also fell. Britain’s Rolls-Royce has scrapped plans for a flying taxi business, nearly three years after its plane broke the airspeed record.

A prototype flying taxi being developed in the United Arab Emirates has been unveiled at a taxi rank outside Charing Cross station in London. Photo: David Parry/Pennsylvania

An industry official said, “A large-scale bubble has occurred.” “We’re finally nearing the end.”

In the longer term, concerns remain about how flying taxis in crowded skies will be regulated. However, the industry received some positive news after US authorities issued regulations on how such vehicles should be operated and how pilots should be trained.

After newsletter promotion

Simpson told investors the company needs about $100 million to cover costs next year. Cash at the end of September was £42.8m.

If negotiations with major financial institutions are successful, the immediate funding crisis may be eased. Fitzpatrick and Vertical have been in talks for nearly a year with Jason Mudrick, an American distressed debt investor who made a fortune investing in “meme stocks” such as AMC Entertainment and GameStop during the pandemic. .

Mudrick proposed converting about half of Vertical’s previous $200 million in financing into equity in exchange for a cash infusion of up to $50 million.

However, in a letter to Vertical’s board last month, he said: “Mr. Fitzpatrick has refused to accept a contractual dilution of approximately 70% of his company’s shares, which he has repeatedly rejected. “There is,” he said.

Mr. Fitzpatrick is seeking a 30% stake, but the deal would leave existing shareholders with only 20% of the company. An agreement could pave the way for other investors to make new equity investments. Candidates could include Virgin Atlantic Airways, American Airlines, and previous investors such as Microsoft and control systems supplier Honeywell.

Vertical boasts a low-cost model of buying off-the-shelf technology from existing suppliers, but it could need $500 million to $1 billion to get through four years without revenue.

Despite investors expressing concerns about launch delays, Simpson said he was “optimistic” about the funding. But with Toyota investing another $500 million in Joby and Beta Technologies raising $300 million last month, some investors believe that if the technology can prove to work, the flying taxi company will still have the cash. He reassured them that they could secure the

“The funding environment is tough and there is a shakeout in the industry,” Simpson said. “I think we’ll be one of the winners.”

Source: www.theguardian.com