The social media platform Reddit’s stocks, traded under the symbol RDDT.N, closed the first day of trading in New York with a 48% increase. This suggests that there is renewed investor interest in initial public offerings (IPOs) of promising yet money-losing companies.

Reddit’s shares closed at a value 48% higher than their initial offering price on the first day of trading, valuing the company at over $9 billion. The stock rose to $57.80 per share, a 70% increase, before settling at $50.44 per share by the day’s end.

The IPO price for the San Francisco-based company was $34 per share, giving it a market value of $6.4 billion. The company and its selling shareholders raised $748 million.

Reddit’s highly anticipated IPO had been in the works for over two years. An IPO filing was made secretly in December 2021 but was delayed due to market volatility. The current valuation marks a decrease from 2021 when it was valued at $10 billion in a private funding round.

Reddit’s strong market entry could yield significant gains for its largest shareholder, Advance Publications. The parent company of Condé Nast, which owns magazines like The New Yorker and Vogue, stands to profit up to $1.4 billion from the IPO. Advance purchased Reddit for $10 million just 18 months after its launch.

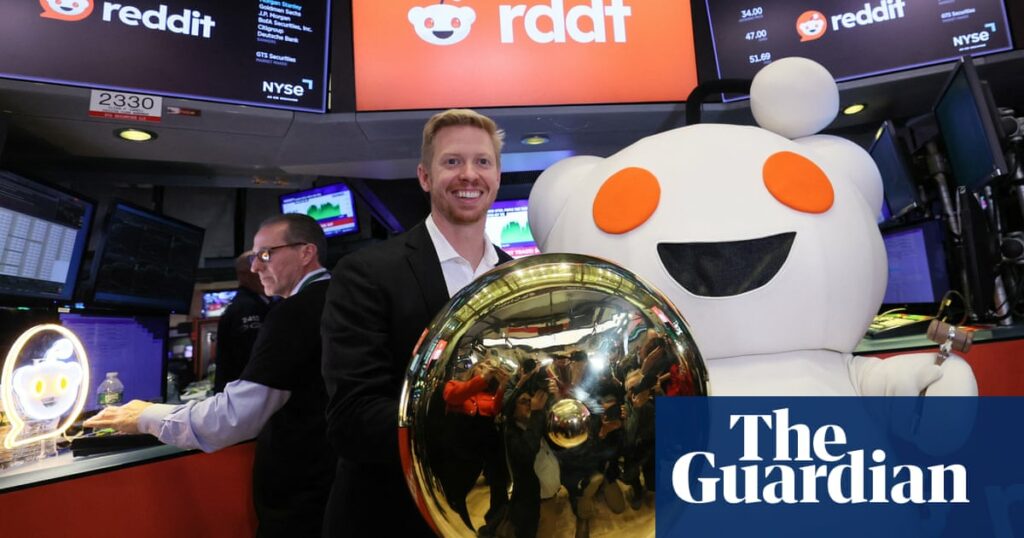

Reddit’s co-founder and CEO, Steve Huffman, received a compensation package totaling $193 million last year. While the site’s other co-founder, Alexis Ohanian, has been a public figure, he does not appear in the company’s filings with U.S. financial regulators.

Major shareholders of Reddit include Chinese gaming company Tencent with an 11% stake, Fidelity with 9.5%, and OpenAI CEO Sam Altman with 8.7%. Reddit was part of the first batch of startups from Y Combinator, where Mr. Altman later served as president.

Reddit’s IPO amid a tech frenzy is expected to give the company a strong market position. However, Julian Klimochko, CEO of Accelerate Financial Technologies, suggests that market performance in the coming weeks will be closely monitored.

“A poor trade by Reddit could impact the IPO market, leading many companies to pause their IPO efforts,” Klimochko stated.

Since its founding in 2005, Reddit has become a cornerstone of social media culture, known for its alien logo on an orange background and its tagline “Front Page of the Internet.”

Reddit hosts over 100,000 online forums called “subreddits” covering a wide range of topics. The platform has been used for various activities, including support groups and interviews, such as the one conducted with Barack Obama in 2012.

Despite its cult status, Reddit has not matched the success of larger rivals like Facebook and Tesla. The company has about 73 million daily unique visitors compared to Facebook’s 2 billion daily logins.

Reddit allocated 8% of its IPO shares to eligible users, moderators, board members, and acquaintances of employees and directors as part of its user appreciation plan. The company is in early stages of monetization and has yet to turn a yearly profit, raising questions about its path to profitability.

“The true test will be after the first earnings report. The results and strategic changes made post-IPO will be crucial,” said Leena Agarwal, director of Georgetown University’s Psaros Center for Financial Markets.

Source: www.theguardian.com