Semiconductors have become a focus of U.S. efforts to thwart China’s technological advances in recent years. Washington is now turning its attention to another hot technology area where China is making significant progress: electric vehicle batteries.

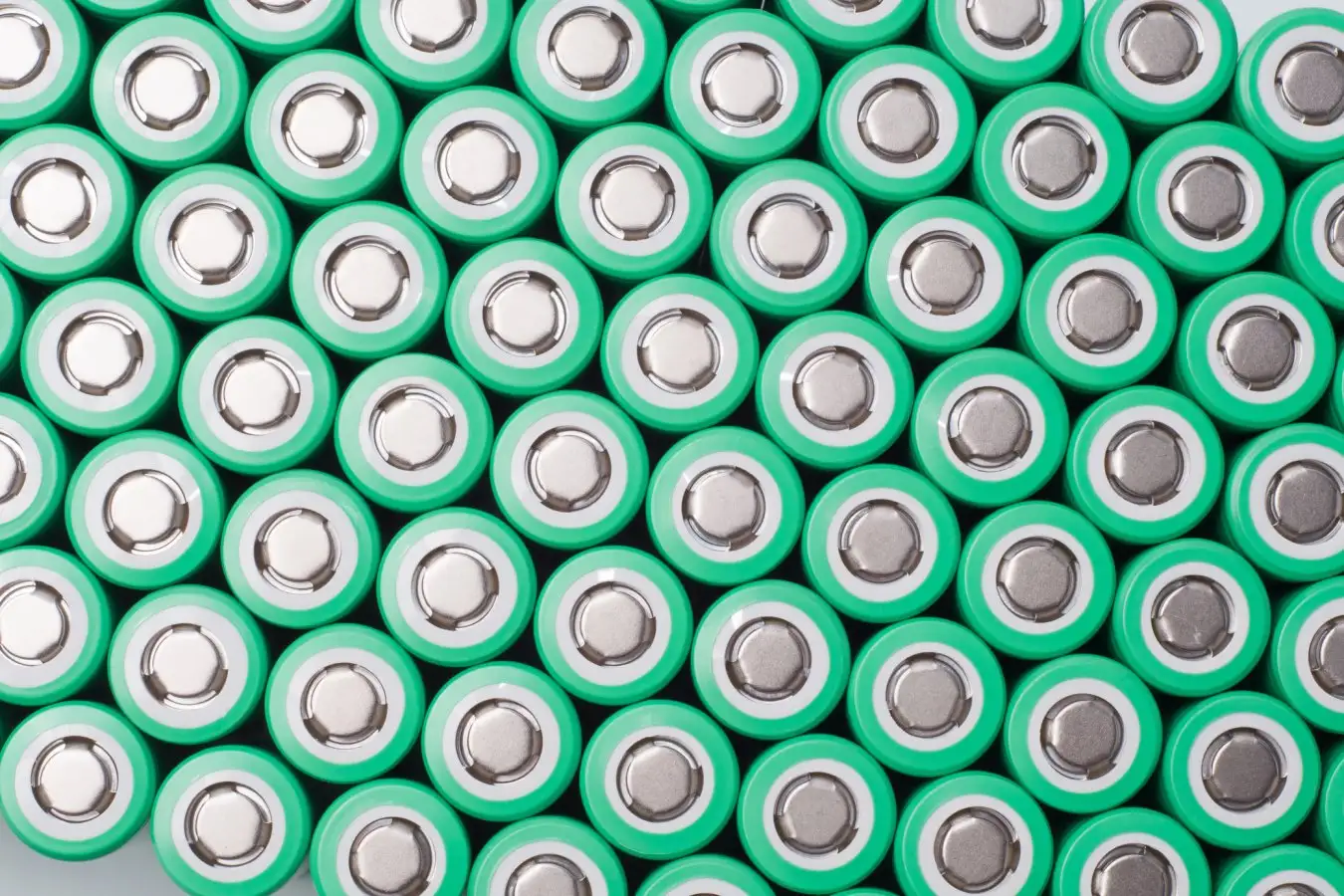

Earlier this month, the Treasury and Energy Departments was suggested Joe Biden approved a rule last year that would limit electric vehicle buyers from claiming tax credits if their cars contain battery materials from China or other countries deemed “hostile” to the United States. Under the president’s flagship climate change law, consumers are entitled to up to $7,500 in subsidies for electric vehicles. Purchasing EVs manufactured in the U.S. using primarily domestic materials.

In response, the Chinese Ministry of Commerce counterattacked Last week, it said the U.S. rules “discriminate against Chinese companies and violate WTO rules.” Excluding Chinese suppliers from U.S. tax incentives is “typical of non-market-oriented policies and practices,” the department said.

The rule, aimed at reducing U.S. dependence on Chinese supply chains in a new era of decoupling, comes as part of the president’s plan to cut global warming greenhouse gas emissions in half by 2030. This is likely to hinder Biden’s efforts to boost sales of EVs.

Also at stake is America’s aim to curb China’s dominance in a field that is booming as countries transition to electric vehicles. China’s two largest battery manufacturers, CATL and BYD, together accounted for about 53% of global EV battery usage in the first 10 months of this year, according to data from China. SNE Research.

According to the research firm, as of the third quarter of this year, China was the world’s largest EV market with a 58% share, followed by the United States and Germany. counterpoint.

Major South Korean companies such as LG, Samsung, and SK On offer competitive alternatives to China’s cheap and advanced batteries and are most likely to benefit from deteriorating US-China relations. . But even the South Korean company is reeling from new geopolitical complications.

Even though SK-on has been approached by both Ford and Hyundai to launch battery projects in the United States, Choi Tae-won, president of parent company SK Group, recently said, blamed The US keeps battery costs high. The artillery division of South Korean conglomerates is now forced to look elsewhere for materials outside of China.China Owns the majority of the global supply chain for EV batteriesfrom mining rare minerals to refining and cell production.

To maintain cost appeal, Chinese battery companies are setting up factories in the U.S. and requiring buyers to continue to qualify for the EV tax credit. Industry giants like Gotion, BYD, and CATL have strategic plans to manufacture in the United States, but the path is not without obstacles. Ford, for example, suspended plans to build a $3.5 billion EV battery factory with CATL in Michigan as U.S. politicians scrutinize its contract with the Chinese company.

Source: techcrunch.com