Nvidia, the chipmaker, revealed its latest financial statements on Wednesday, with revenue reaching $30.04 billion in the last three months. This is a significant increase of 122% compared to the previous year, indicating sustained growth in their artificial intelligence investments.

Despite analysts’ projections of $28.7 billion in sales, the company’s shares dropped more than 3% in after-hours trading.

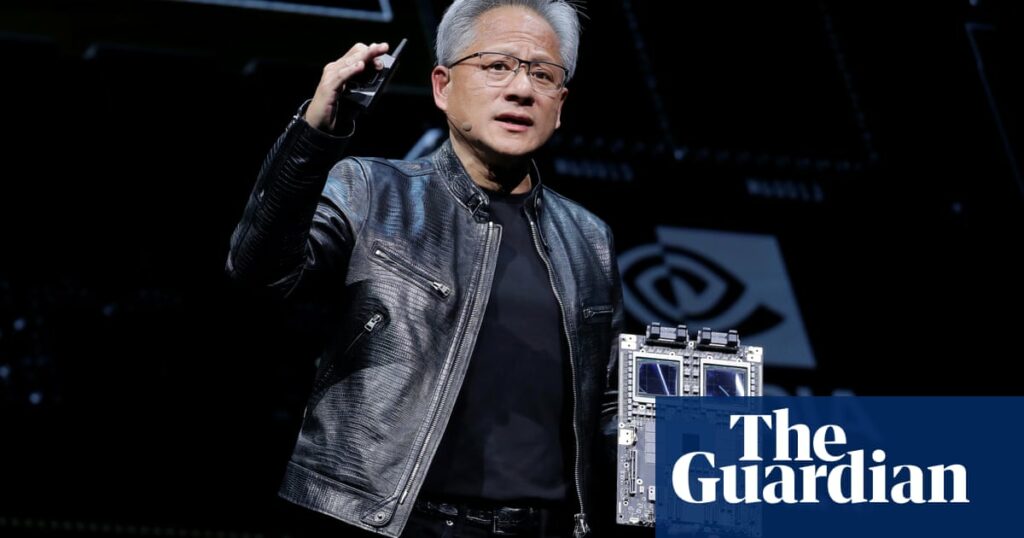

Nvidia’s founder and CEO, Jensen Huang, announced plans to ship a greater number of chips and hardware next year than in the company’s 31-year history during an earnings call.

Huang highlighted the importance of fast development due to the increasing complexity of their models. He stated that the company aims to lower costs while scaling AI models to unprecedented levels for the next industrial revolution.

Analysts, while optimistic about the results, acknowledged signs that Nvidia’s exceptional revenue growth might be slowing down. Major tech companies’ aggressive AI investments are driving demand for Nvidia chips, but these companies are also investing in their own silicon development.

The company informed customers about a delay in the launch of their next-generation AI chip, known as Blackwell. Early samples have already been sent to a limited number of customers. Despite this, the current graphics processing unit, Hopper, continues to sell well according to CEO Jensen Huang.

Nvidia reported record revenue with a 154% increase in data center revenue year over year, amounting to $26.3 billion, reflecting the demand for accelerated computing and generative AI in data centers globally.

Nvidia’s earnings results hold great significance on Wall Street, as the company accounts for 6% of the total value of the S&P 500 and is the third-largest company globally with a market capitalization of $3.1 trillion.

Recent reports from major tech customers such as Microsoft, Amazon, Meta, and Google, show increased capital spending as they utilize Nvidia chips to develop and train their AI models.

The company’s earnings per share were $0.68, and they announced a $50 billion share repurchase. Profit is expected to rise to $15.1 billion, up from approximately $6.2 billion in the same period last year.

Ives, a Wedbush analyst, emphasized the importance of Nvidia’s earnings report on the stock market, estimating that every dollar spent on Nvidia’s GPU chips contributes $8 to $10 to profits across the tech sector.

The market’s focus on Nvidia’s performance stems from the belief that AI advancements will boost global productivity for years to come.

Comparisons to the Internet bubble of the late 1990s have emerged, with concerns that the AI boom might peak if Nvidia’s results disappoint investors.

Regulators are closely monitoring Nvidia, following an antitrust investigation launched by the Department of Justice after allegations from rival chipmakers. The investigation claims Nvidia is using its market power to monopolize markets and compel customers to continue buying its products.

Source: www.theguardian.com